Additionally, Binance operates a 'maker' and 'taker' system on most instruments, and discounts are available when you hold BNB Coins or you trade large volumes. Trading fees and commissions at Binance will vary wildly depending on the specific market you are looking to access. Next up in our Binance vs Coinbase comparison we are going to break down what fees the two platforms charge.

Binance vs kraken 2021 full#

You can read our Coinbase review to get a full breakdown of what cryptocurrencies the platform supports. These can be bought, sold, and traded relatively easily at Coinbase. In fact, at the time of writing, Coinbase is home to just 64 cryptocurrencies.

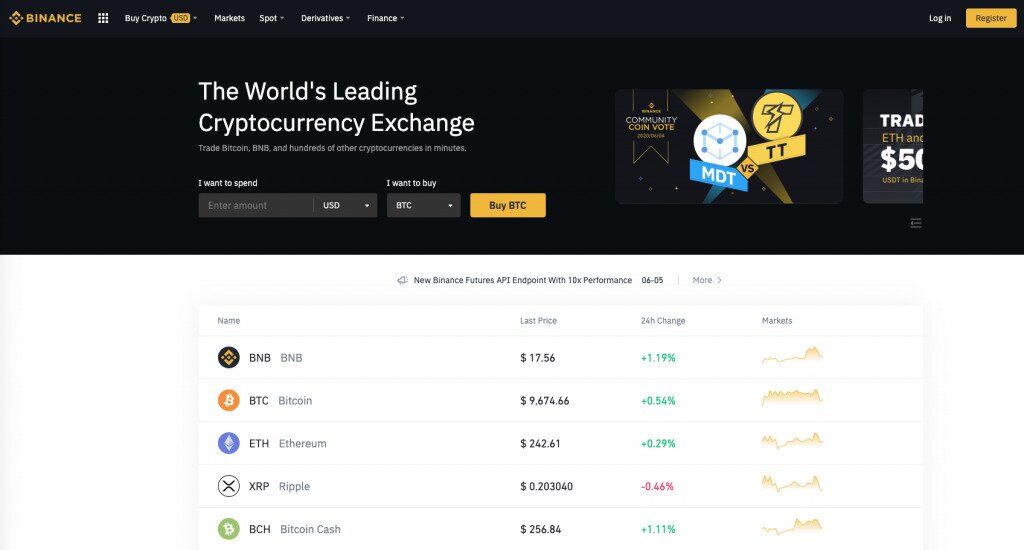

Things are a bit more simple over at Coinbase, as the number of supported coins and markets is considerably lower than that of Binance. This largely focuses on Bitcoin against Tether - meaning that you will be speculating on the future value of BTC/USDT. You then have the crypto derivative department, which covers futures and vanilla options. In particular, this includes a significant number of ERC-20 tokens. In fact, Binance is often the go-to place to purchase newly created tokens that have yet to be listed on other exchanges. If, however, you are planning to use the Binance exchange, you'll have access to hundreds of digital currencies. This covers a good blend of options - ranging from Bitcoin, Ripple (XRP), BNB, Cardano and Dogecoin to Ethereum, and Vechain. For example, if you want to buy cryptocurrency instantly with a Visa or MasterCard, you will have access to 28 coins. Starting with Binance, the platform's list of supported markets will ultimately depend on what you are looking to achieve. In the first section of our Binance vs Coinbase review, we are going to discuss which cryptocurrencies the platform supports. Coinbase offers a fully-fledged crypto debit card as well as corporate investments. Binance also offers crypto savings accounts. Binance and Coinbase have since expanded into a range of other crypto-related products and services.įor example, Binance offers cryptocurrency derivatives – which is inclusive of both Bitcoin futures and options. In terms of their core services, both Binance and Coinbase offer brokerage services that allow you to buy cryptocurrency with a debit card or bank account transfer.īoth platforms also offer exchange services that are more suited to active day traders. In the 24 hours prior to writing this comparison page, Binance facilitated more than $26 billion in trading activity. The platform last reported that it is now being used by over 100 million traders. Since then, Binance has grown to become the largest cryptocurrency exchange in the space – both in terms of customers and trading volume. Binance, on the other hand, wasn’t launched until 2017. At the time of writing, Coinbase is trading with a market capitalization of just over $49 billion. The platform also went through its initial public offering earlier this year – opting for the NASDAQ.

Launched in 2012, Coinbase is now home to over 35 million customers. They are both home to billions of dollars worth of trading activity each and every day – which is why the two platforms now boast a huge customer base. What are Binance and Coinbase?īinance and Coinbase are cryptocurrency exchanges that dominate the industry. Within it, we cover each and every factor that needs to be considered – such as supported coins, commissions, minimum deposits, payment methods, safety, and more. If so, this Binance vs Coinbase Comparison is a must-read. Looking to trade cryptocurrencies online but not sure whether Binance or Coinbase is right for you? Cryptoasset investing is highly volatile and unregulated in some EU countries.

0 kommentar(er)

0 kommentar(er)